Navigating the future: AI's impact on wealth management firms

In recent months, the financial services industry has witnessed significant advancements in artificial intelligence (AI), sparking both excitement and apprehension amongst wealth managers. While the potential benefits of AI are undeniable, the wealth management sector has been understandably cautious in embracing this transformative technology. This hesitation can be attributed to several factors, including a prioritisation of addressing critical gaps in services, concerns about client relationships, and the unique needs of different market segments.

In this blog, we explore the hopes and fears of integrating AI in wealth management, balancing the potential savings and efficiencies that can come from technological advancement alongside the concerns over an erosion of personalised client services.

Back office transformation

The potential for improved efficiency through AI and machine learning is substantial, particularly in areas like automating trade settlements, automating regulatory compliance, and risk management.

However, within the technology function of many wealth management firms, the primary focus often relates to implementing new traditional services and upgrades to address key operational gaps. Implementing non-AI solutions to enhance services such as regulatory compliance, Environmental, Social, and Governance (ESG), Customer Relationship Management (CRM), and digital services are typically considered more important and lower risk.

Because of the potentially significant benefits and the remarkable pace of change in AI, we believe that wealth management firms should put aside time and budget in 2024 to carefully evaluate the potential efficiencies and cost savings offered by AI, balancing these against the benefits of their current project portfolio. This assessment will help determine if prioritising AI integration is a strategic move that aligns with their operational goals.

Front office dilemma

We are starting to see the emergence of more AI-powered tools that can transform the front office experience for wealth managers and their clients. Early adoption of these innovations has the potential to allow client advisors and relationship managers to better serve “mass affluent” clients. Use of AI in this environment could combine the advantages of a human-led personalised service and advisor judgement with the scalability and insights that AI can provide.

However, implementation of AI in the front office remains a challenge. Securing funding to develop new AI capabilities requires proof of value to the organisation and clients. Wealth managers must also weigh up the benefits against factors such as data and integration challenges, evolving financial services regulations for AI, and the perceived lack of trust from clients in insights generated from AI.

Industry evolution

We believe a small number of early adopting wealth managers armed with AI capabilities are likely to start disrupting the industry at some point in the next year. Developing a strategy, plan, and business case for AI integration is important to avoid being left too far behind.

Key considerations

- Early adoption dilemma: The decision to be an early mover or a follower with respect to AI in the wealth management market needs careful consideration of the associated risks and rewards.

- Barriers to progress: For those who decide to invest in AI, there are some foundational elements that could act as barriers to AI progress if not addressed:

- Data governance and quality: Building a foundation of sound data governance and ensuring data quality is imperative for effective AI implementation. This discipline is important in any organisation but vital to get the best out of AI solutions.

- Robust data infrastructure: Modern platforms with adaptability to change swiftly are most suitable to form the backbone of successful AI integration.

- Skilled resources: The availability of appropriately skilled individuals is critical for navigating the complexities of enterprise AI.

Conclusion

As the wealth management sector contemplates the role of AI, a delicate balance must be struck between embracing innovation and preserving the personal touch that defines many client relationships. While challenges exist, we believe that the potential rewards in terms of cost savings, productivity gains, and enhanced client experiences will make the journey towards AI integration worthwhile. Wealth managers should consider their strategy for when and how to look at the opportunities that AI can provide for them to ensure that they don’t fall behind their competitors.

CONTACT US TO FIND OUT HOW WE CAN HELP

We are delighted to welcome a new Partner for Financial Services Sector!

Curzon Consulting has appointed Andy Stewart as Partner – Financial Services, starting in October.

Andy will help drive the strategy in the financial services market, which is core to Curzon’s growth plans for the future. Working with Douglas Badham, Partner & Financial Services Sector Lead, Andy will be responsible for developing new and innovative propositions and go-to-market approaches as well as managing some of Curzon’s long-term client relationships.

Andrew Morgan, Managing Partner, Curzon said: “It’s fantastic that Andy has joined the team. He brings a wealth of background and experience that will help us add even more value to our financial services clients”

Douglas Badham, Partner & Financial Services Sector Lead, Curzon said: “I look forward to working with Andy as his expertise and strong client relationships will be invaluable to us as we execute our growth strategy”

Andy Stewart, Partner – Financial Services, Curzon said: “I’m excited to be joining the team at Curzon as they have long been committed to outstanding client service and the delivery of tangible results for their clients. I’m looking forward to getting started”

CONTACT US TO FIND OUT HOW WE CAN HELP

The Future of Work in Financial Services

The last 15 months had seismic impacts on workforces and ways of working

Banks and insurers weren’t prepared for the pandemic – within days nearly every employee was working from home, all of the time. The initial response was crisis-mode transferral of existing activities, processes and tools to remote – with minimal adaptation.

Most organisations surprised themselves at how quickly this was achieved and asked why they couldn’t make change happen as fast outside of a crisis.

Rises in workforce productivity were reported (less evidenced), but this was partly driven by fear of job loss.

Homeworking conditions varied enormously, with many people dealing with cramped, noisy environments, unreliable internet connectivity, and competing childcare and work demands

Protracted home-working suited some but caused a widespread decline in mental and physical wellbeing for others*, particularly in larger households:

- 46% taking less exercise and 39% developing musculoskeletal problems

- 59% finding it harder to switch off from work and 37% reporting disturbed sleep

- 67% feeling less connected to or isolated from colleagues

- 41% of those living in households with 3+ people think working from home is worse for their health and wellbeing, vs 29% of those living on their own and 24% of those living with just their partner

Business leaders had to respond to a wave of 'here & now' imperatives

How to:

- Immediately ensure operational resilience and prioritise access for those who most needed service

- Adapt and mobilise rapidly to deliver Government-backed support scheme (BBLS, CBILS)

- Avoid customer resentment or loss as a consequence of exceptional service constraints – e.g. motor and health insurers compensating policyholders for reduced need to claim or ability to fulfil claims

- Best minimised disruption and restore service quality for all partners and customers

- Accelerate process and service digitisation to enable all this, e.g. increased chatbot use to manage contact demand

- Provision to manage significant financial risk, e.g. bad loans for banks and increased claims volumes for Life insurers

- Minimise furlough and redundancies and keep colleague morale and motivation high

- Ensure a safe, confident return to the workplace during those periods when permitted/required to

Expansive, strategic initiatives – like progress on sustainability, operating model and core technology change – were largely relegated down the agenda

Today’s focus is on transitioning to new ways of working which will best advantage organisations and colleagues after restrictions end

- The Government requirement to work from home whenever possible lifts on July 19th

- Though uncertainty continues with some senior scientific advisers urging continued working from home over the summer

- Return to the workplace is underway within Financial Services albeit under varying conditions, speeds and guidance

- Lots has been done on scenarios and plans for what the new ways of working will look like, and how they will be better…

But how ready are banks and insurers to execute their plans and take full advantage of the many opportunities the transition offers?

Visions of the Future of Work vary, and the best solution to many implementation complexities is not yet known

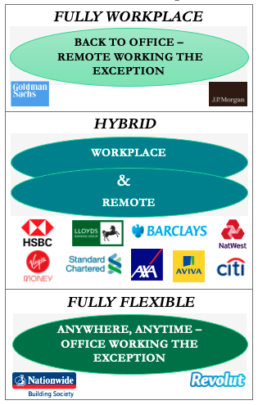

Simplistically, strategies divide between three broad options

But one size won’t fit all

There are multiple work ‘personae’ with different required and desired ways of working:

- e.g. in the wealth management division of a bank, traders may be encouraged back to the office full time…

- where, Ops and Technology colleagues shift to a 1:3:1 week [1 day in the office, 3 at home, 1 flexible]

- while private banking account managers go to fully flexible

Many questions still need working through before the optimised hybrid model is found such as:

- What will the office be used for on return – which tasks and activities need to be conducted there and what changes in office design/functionality will best support those?

- What and how should policies flex to deal with exceptions, e.g. for people with lower comfort levels about returning to office-based or more cautious views of ongoing Covid risks?

- Where and how should front/middle/back-office processes and controls differ between the office and home?

- Where and why should this prompt a reshuffle of roles, interfaces, activities to maximise performance?

- Do certain roles no longer need to be attached to a site/location? E.g. could a UK job be done 100% from home in France?

- How to ensure similarity between home and office experience where it matters to avoid some colleagues feeling disconnected, and to bolster inclusivity?

- To what extent will savings from reduced office space outweigh costs of standardising/upgrading home working equipment, furniture, and technology?

The challenge is now to successfully translate the vision into the new operating and cultural reality… and deliver maximum benefit from it

The Future of Work challenge facing organisations now is how to actually ‘make it happen’

Moving to action is the hard part, and in our view, the effort needs two strongly coordinated legs:

- Piloting the practical changes needed to establish and embed target new ways of working – testing/learning and refining at pace to best effect across the entire business, attuned to the needs of different work personae

- Designing and delivering deeper change that goes beyond just re-configuring office space – to create maximum value by converting the breadth and depth of opportunities opened up by the FoW, so…

- Optimise and flex office access and space in synch with hybrid working needs

- Perfect the work-at-home equipped-ness and experience

- Convert cost-savings from real estate footprint and usage reduction

- Organise across functions and silos for hybrid working effectiveness

- Link WoW changes to delivery of CN0 & cost optimisation goals

- Raise employee engagement as a purpose-based organisation

- Improve management, coaching, motivational techniques and controls to bridge in/out office split

- Skills & behaviours ‘upgrade’ for higher performance and positive culture change

- Enrich diversity and recruit the best talent from a wider geography

- Re-think routine activities for maximum efficiency

- Introduce smarter working processes to boost productivity

- Drive those pandemic customer behaviours (like increased digital payments) which boost productivity and enhance CX

- Adopt best collaboration tools and AI/automation technology to improve work quality, pace, output

- Clear out under-utilised or no longer fit for purpose office collaboration / workflow tools

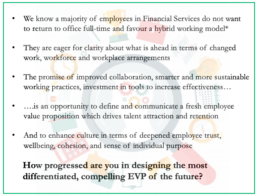

In delivering holistic change there is a golden opportunity to redefine the employee value proposition and enhance culture

Holistic change approach to the Future of Work

Designing to most compelling EVP for the future

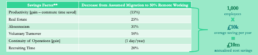

The human and commercial benefits of getting this right are BIG

Banking and insurance have amongst the highest remote working potential of any sector, with around three-quarters of time spent on activities that can be conducted remotely, without the loss of productivity*

Indicate scale benefits of transitioning to 50% remote working are £10M annual savings per 1,000 employees

There are important human capital and reputational /social responsibility benefits to derive from improved employee experience and accelerated reduction in the organisation’s carbon footprint***

* Source McKinsey / What’s Next for Remote Working

** Source Global Workplace Analytics, Amazon, SHRM, Deloitte – average annual savings include the cost of office rent, electricity, water, insurance supplies. Savings based on full-time employees with compatible jobs telecommuting 20 hrs/wk. Assumes 2,000 hour work year and £70/hr labour rate

*** Source Carbon Trust / Homeworking

So… the questions we think you need to be able to answer are…

Strategy

Does your FoW vision and ambition reach far enough?

Is your FoW strategy holistic and clear on what benefits the new ways of working should deliver, in terms of

- human capital

- culture change

- productivity

- operational efficiency

- customer experience

- cost optimisation

- carbon reduction

How robust is the supporting business case and rationale?

Change Design

Do change designs have the necessary sensitivity and granularity at policy, process, controls and performance management levels? Do they have

- defined rules and variability on when in-person presence is required by specific roles, activity mixes and situations

- mitigations of risk of accentuating inequalities and creating new psychological or emotional stresses amongst employees

Test – Learn – Optimise

What will it take to pilot, refine and embed the transition effort successfully and at pace?

Enablement

What needs to be achieved to ensure the organisation and people are ready to adopt the new ways of working?

Have you identified/selected the optimal system, technology and data solutions to enable the hybrid working model?

Benefit Capture

To what degree can you be confident you have the right implementation plans, measures and capabilities to realise the target model and benefits?

We would welcome a discussion to understand where you are in moving from visioning to delivering FoW and which questions matter most to you, and to explore where Curzon’s capabilities may be relevant to your needs

CONTACT US TO FIND OUT HOW WE CAN HELP

Future of Work insights

Sign up to our insights

Developing multiple pathways and identifying over £16m cost savings at a major health insurer

The issue

- Pressure to increase efficiency in their claims due to rising medical costs

- Large variation in costs between suppliers and across the UK

- Lack of structured routing for members to effective treatments and cost efficient providers across hospitals, clinics or doctors

- Poor cost control with growing pressure to tackle medical costs due to rising claims and pressure on margins

- Difficulty negotiating cost reductions with hospitals, and huge number of suppliers (including doctors) to manage

What we did

- Initial project to identify opportunities for cost reduction for specific saving target (£16 million in year)

– Developed and prioritised 14 opportunities

– Integrated milestone plans to achieve savings that year - Second phase project to extent treatment pathway opportunity (MSK) and develop new treatment pathways

– Identified possible treatment pathways in major medical treatment areas

– Developed and communicated a new analytical methodology to understand spend variance, behaviour across specialists, by hospital and pathway

– Collaborated with medical experts to develop care journeys to triage, treat and follow up

– Business cases developed to support cost effective pathways roll out

The results

- £16 million in cost savings in year identified and resource planning completed to ensure in year delivery

- Identified a solid saving of up to £36 million cumulatively over three years via medical pathways

- Trained out how to use new analytical methodology

- Delivered relevant and valuable research (internal / external) to underpin treatment pathways including medical studies, historic analysis and case studies of implementation

£16m

cost savings identified

£36m

savings identified cumulatively over three years via medical pathways

What our clients say

“As a result of Curzon’s support a strategic and digital leap has been made in how we manage the entire asset lifecycle to transform our Developer Service experience. This is a programme and a product that sets a new benchmark within the industry.”

Jason Tucker

Director of Alliances & Integrated Supply Chain, Anglian Water

CONTACT US TO FIND OUT HOW WE CAN HELP

Chairman's Masterclass: "The Challenge of Longevity"

Event: The Challenge of Longevity27 November 2019, London

Event details

Where: Central London

When: 7pm-10pm, 27 November 2019

What: Dinner, Speech from AIG CEO Adam Winslow and Q&A

About the speaker

On 27 November 2019 we will be joined by Adam Winslow, Interim Chief Executive Officer of AIG’s global Life Insurance business, to discuss the Challenge of Longevity.

American International Group, Inc. (AIG) is a leading global insurance organisation with operations in over 80 countries.

Adam is responsible for AIG’s global life business (US and international). He also is a member of AIG’s Life and Retirement Executive Team.

Adam has served as Executive Director, UK Distribution; COO, EMEA Consumer; CEO, AIG Life Ltd (UK), and CEO, International Life and Retirement in London, before he was named Chairman of the Board of the AIG GBN pooling network in January, 2019.

Previous to working with AIG, he served various roles at Laya Healthcare, Aviva, BGL Group, and Allianz Global Investors.

Who should attend?

The Chairman’s Masterclass Dinner Series is a forum for senior business to discuss topical issues under Chatham House Rules.

Typical attendees include Chief Executive Officers, Chief Financial Officers, Chief Commercial Officers, Chief Strategy and Transformation Officers, Managing Directors and business unit Directors.

Register your interest

Complete this form or email events@curzonconsulting.com to register your interest

Please note that spaces are limited.

This is the latest event in our Chairman’s Masterclass Dinner series, providing UK business leaders with insight for over a decade.

Register your interest to attend this event in London, UK.

Please note that spaces are limited.

Other events

CONTACT US TO FIND OUT HOW WE CAN HELP

Unlocking over £20m in increased gross margin at a major health insurer

The issue

- Shrinking customer base

- 13 legacy books and numerous policy variants causing customer and staff confusion

- Operationally complex to manage – high cost to serve

- Existing proposition and pricing created trigger points for customer exit

- Customers not segmented by value

- No differentiated renewal or save strategies

- Not pricing for risk or maximised value retention

- Poor customer journey: passed from function to function, advisors not empowered

What we did

Designed & executed a pricing, product and service migration of all policyholders to one new modular product

- Developed new proposition which drove retention of high value customers and higher return from lower value customers

- Built in upgrade/downgrade ‘right-size’ choices to mitigate competitor switching

- Created pricing engine enabling all business to move to NCD-based policies and set renewal premiums to optimise gross margin

- Cut expected IT lead time to launch from 12 to 3 months

- Changed customer communications and management processes to de-risk customer disruption & loss

- Engaged Legal and regulator on ‘automatic renewal’ plans throughout

- Piloted the transition on 2 highest lapse-risk books to ensure error-free process and no adverse increase in lapse rates

The results

- Exceeded the £20Mpa gross margin improvement target

- Reduced customer loss by 25%

- Improved operating cost ratio from 30% to 16% with greatly improved IT flexibility

- Excellent customer and FSA feedback

- Successfully rolled out from personal to SME & Group schemes

£20m

exceeded the gross profit margin improvement target

25%

reduced customer loss

14%

reduction in operating costs

What our clients say

“As a result of Curzon’s support a strategic and digital leap has been made in how we manage the entire asset lifecycle to transform our Developer Service experience. This is a programme and a product that sets a new benchmark within the industry.”

Jason Tucker

Director of Alliances & Integrated Supply Chain, Anglian Water

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

Change management optimisation at a UK retail bank

The issue

- Unprecedented customer growth & branch expansion coupled with focus on improving service delivery and customer satisfaction placed pressure on our client to deliver greater and more complex change

- A need to improve the architecture and governance of business process change

- To ensure change management is ready and optimised for successful delivery of current and downstream change demand

- Rapid growth brought complexity & uncertainty

- There was a need for tightly defined governance mechanisms supported by a standardised way to adhere to change

What we did

- Designed framework for a multilevel business change process architecture to facilitate effective governance

- Translated the framework into a new change management model with new working practices & Balanced Scorecard

- Consistent communication and deployment in line with organisation’s need

The results

- Building blocks in place for bank to deliver its growth strategy securely

- Reduced change backlog

- Change management framework to drive sustainable change and maximise results implemented across bank operations

- Agreed metrics/KPIs at selected organizational levels including baselines and targets

What our clients say

“As a result of Curzon’s support a strategic and digital leap has been made in how we manage the entire asset lifecycle to transform our Developer Service experience. This is a programme and a product that sets a new benchmark within the industry.”

Jason Tucker

Director of Alliances & Integrated Supply Chain, Anglian Water

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

Improving customer satisfaction at a leading retail and commercial bank

The issue

- Continuing declines in NPS and CRI scores across retail and commercial customer bases

- Board’s ambition was to achieve market-leading customer recommendation levels

- Ongoing customer service challenges driving up customer dissatisfaction ― but unclear as to true extent and causes

- Big gaps between customer expectations and delivery

- True extent of customer dissatisfaction not identified or addressed, and NPS surveying not used to mine for triggers. 40% of customers thought they had complained vs 4.5% recorded

- Reality was 45% of customers who’d formally complained were dissatisfied with complaint resolution, making them far more likely to churn (62%)

What we did

Designed & executed a pricing, product and service migration of all policyholders to one new modular product

- Worked across retail and commercial banking operations to understand and map impacts of service failures and complaints response on NPS and CRI scores

- Identified biggest linkages between types of service failure, quality/ timeliness of complaint resolution, and the creation of Detractors

- Surfaced major under-reporting of complaints and inaction where known detractors continued to be detractors

- Developed set of targeted remedial actions to apply at point of service failure or complaints to prevent creation of detractors or convert them into neutral/advocates, minimising risk of eventual lapse

- Defined how to cost-effectively and proactively pinpoints and stop service failures occurring

- Designed operational changes in four customer management areas across Retail & Commercial Banking to reduce service failure and complaints volumes and costs

The results

- Recommendations agreed by both divisions

- Transition plans delivered

- ExCos in implementation

- Reported improved NPS & satisfaction rate scores

- On-target run-rate cost reduction benefits

What our clients say

“As a result of Curzon’s support a strategic and digital leap has been made in how we manage the entire asset lifecycle to transform our Developer Service experience. This is a programme and a product that sets a new benchmark within the industry.”

Jason Tucker

Director of Alliances & Integrated Supply Chain, Anglian Water

An award-winning team

CONTACT US TO FIND OUT HOW WE CAN HELP

New rules for insurance customer growth

Curzon Consulting Financial Services lead Doug Badham discusses the “New rules for customer growth” for insurance companies in an article for Raconteur.

New Rules for Customer Growth

The old norms of insurance cause a lot of customer pain: ever-rising premiums, slow and undifferentiated service, complex procedures and poor communications. But big changes are afoot. Insurance customers want better for less as rapid technology advancement continuously raises service expectations – and disruptive new entrants are riding the wave. Inward-looking insurers ignore this at their peril. Doug Badham said:

“We believe the industry has passed the point where it’s possible to grow profitably by sticking to the old rules,”

Successful net insurance customer growth now depends on embracing a new set of rules.

All customer contact is precious and should be as convenient as possible

Policyholders expect to be treated as valued customers, able to interact 24/7 across joined-up access points as they do in other sectors. Seamless access boosts retention and reduces overall cost to serve, and requires digital enablers to be at the heart of the insurer’s operating model.

“Insurers can no longer hide behind data security and Financial Conduct Authority (FCA) regulation as reasons not to allow multiple channel completion of processes,” says Mr Badham

The focus must be on retention from day one

Keeping customers is harder than ever: switching, reducing or dropping cover has been rising steadily due to household cost-cutting and self-researched offer-hopping, leaving some underinsured. Use of comparison sites also means consumers leave bigger data footprints, which ratchets up competitor targeting of renewal dates. To defend against this, care and consistency must be core to the entire customer journey. The jolt when a frictionless sales process gives way to a clunky claims procedure won’t be tolerated.

As Mr Badham explains: “Optimising claims experiences and making best use of technology to help customers minimise the cost of a claim, or not have to claim, is how retention battles will be won.” Take the LeakBot recently introduced to homecare cover, which alerts customers to first signs of a leak before worse damage ensues. Alongside claims experience, affordability is a prime reason for customer exit and another cornerstone of retention effectiveness will be the increasingly precise, personalised renewal pricing artificial intelligence can deliver.

Have more meaningful customer communication more of the time

Too often insurers’ attempts to communicate have an adverse rather than positive impact. Providers need to treat every customer touchpoint as an opportunity to demonstrate the value of their cover, particularly since April 2017’s FCA renewals regulation, which requires every renewal notice to encourage customers to shop around.

The best will use analytics to provide genuinely beneficial, timely insight that allows customers to understand and minimise their risk, for example: “You are regularly braking sharply and exceeding speed limits.” According to Mr Badham: “What’s happening in health insurance, where providers are transforming from benign payers to lifelong wellbeing partners, is likely to be followed in motor, home and other lines.”

Rebuild or build a brand based on trust and followership

Insurance has become something of a dirty word in recent years, with many incumbents losing customer trust. Restoring it is partly about making the move from a back-office-centric operating model to one that delivers digitally driven customer management and contact excellence. On top of this, compelling brand proof points are crucial to fend off powerful non-insurance brands that have taken a foothold, such as John Lewis, and to combat price erosion from online distribution challengers. It won’t be a case of outspending them. The insurers who cut through the noise of comparison tables and “expert” web articles will be those earning and sustaining customer advocacy through trusted recommender communities and app-based insurance aggregators such as Boughtbymany and Brolly.

There’s no hiding place from the disruption. Shedding the old rules and becoming a genuinely customer-driven insurer – in the customer’s eyes – is what it will take to thrive in the new environment.

This article originally featured in Raconteur, April 2018

About the author

Douglas Badham

I lead our Financial Services practice, supporting banking, insurance and wealth management clients at a time of enormous disruption and change in the industry.