The last 15 months had seismic impacts on workforces and ways of working

Banks and insurers weren’t prepared for the pandemic – within days nearly every employee was working from home, all of the time. The initial response was crisis-mode transferral of existing activities, processes and tools to remote – with minimal adaptation.

Most organisations surprised themselves at how quickly this was achieved and asked why they couldn’t make change happen as fast outside of a crisis.

Rises in workforce productivity were reported (less evidenced), but this was partly driven by fear of job loss.

Homeworking conditions varied enormously, with many people dealing with cramped, noisy environments, unreliable internet connectivity, and competing childcare and work demands

Protracted home-working suited some but caused a widespread decline in mental and physical wellbeing for others*, particularly in larger households:

- 46% taking less exercise and 39% developing musculoskeletal problems

- 59% finding it harder to switch off from work and 37% reporting disturbed sleep

- 67% feeling less connected to or isolated from colleagues

- 41% of those living in households with 3+ people think working from home is worse for their health and wellbeing, vs 29% of those living on their own and 24% of those living with just their partner

Business leaders had to respond to a wave of 'here & now' imperatives

How to:

- Immediately ensure operational resilience and prioritise access for those who most needed service

- Adapt and mobilise rapidly to deliver Government-backed support scheme (BBLS, CBILS)

- Avoid customer resentment or loss as a consequence of exceptional service constraints – e.g. motor and health insurers compensating policyholders for reduced need to claim or ability to fulfil claims

- Best minimised disruption and restore service quality for all partners and customers

- Accelerate process and service digitisation to enable all this, e.g. increased chatbot use to manage contact demand

- Provision to manage significant financial risk, e.g. bad loans for banks and increased claims volumes for Life insurers

- Minimise furlough and redundancies and keep colleague morale and motivation high

- Ensure a safe, confident return to the workplace during those periods when permitted/required to

Expansive, strategic initiatives – like progress on sustainability, operating model and core technology change – were largely relegated down the agenda

Today’s focus is on transitioning to new ways of working which will best advantage organisations and colleagues after restrictions end

- The Government requirement to work from home whenever possible lifts on July 19th

- Though uncertainty continues with some senior scientific advisers urging continued working from home over the summer

- Return to the workplace is underway within Financial Services albeit under varying conditions, speeds and guidance

- Lots has been done on scenarios and plans for what the new ways of working will look like, and how they will be better…

But how ready are banks and insurers to execute their plans and take full advantage of the many opportunities the transition offers?

Visions of the Future of Work vary, and the best solution to many implementation complexities is not yet known

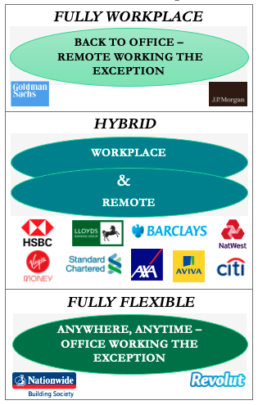

Simplistically, strategies divide between three broad options

But one size won’t fit all

There are multiple work ‘personae’ with different required and desired ways of working:

- e.g. in the wealth management division of a bank, traders may be encouraged back to the office full time…

- where, Ops and Technology colleagues shift to a 1:3:1 week [1 day in the office, 3 at home, 1 flexible]

- while private banking account managers go to fully flexible

Many questions still need working through before the optimised hybrid model is found such as:

- What will the office be used for on return – which tasks and activities need to be conducted there and what changes in office design/functionality will best support those?

- What and how should policies flex to deal with exceptions, e.g. for people with lower comfort levels about returning to office-based or more cautious views of ongoing Covid risks?

- Where and how should front/middle/back-office processes and controls differ between the office and home?

- Where and why should this prompt a reshuffle of roles, interfaces, activities to maximise performance?

- Do certain roles no longer need to be attached to a site/location? E.g. could a UK job be done 100% from home in France?

- How to ensure similarity between home and office experience where it matters to avoid some colleagues feeling disconnected, and to bolster inclusivity?

- To what extent will savings from reduced office space outweigh costs of standardising/upgrading home working equipment, furniture, and technology?

The challenge is now to successfully translate the vision into the new operating and cultural reality… and deliver maximum benefit from it

The Future of Work challenge facing organisations now is how to actually ‘make it happen’

Moving to action is the hard part, and in our view, the effort needs two strongly coordinated legs:

- Piloting the practical changes needed to establish and embed target new ways of working – testing/learning and refining at pace to best effect across the entire business, attuned to the needs of different work personae

- Designing and delivering deeper change that goes beyond just re-configuring office space – to create maximum value by converting the breadth and depth of opportunities opened up by the FoW, so…

- Optimise and flex office access and space in synch with hybrid working needs

- Perfect the work-at-home equipped-ness and experience

- Convert cost-savings from real estate footprint and usage reduction

- Organise across functions and silos for hybrid working effectiveness

- Link WoW changes to delivery of CN0 & cost optimisation goals

- Raise employee engagement as a purpose-based organisation

- Improve management, coaching, motivational techniques and controls to bridge in/out office split

- Skills & behaviours ‘upgrade’ for higher performance and positive culture change

- Enrich diversity and recruit the best talent from a wider geography

- Re-think routine activities for maximum efficiency

- Introduce smarter working processes to boost productivity

- Drive those pandemic customer behaviours (like increased digital payments) which boost productivity and enhance CX

- Adopt best collaboration tools and AI/automation technology to improve work quality, pace, output

- Clear out under-utilised or no longer fit for purpose office collaboration / workflow tools

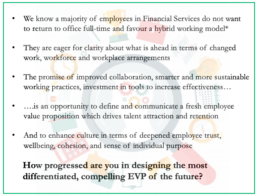

In delivering holistic change there is a golden opportunity to redefine the employee value proposition and enhance culture

Holistic change approach to the Future of Work

Designing to most compelling EVP for the future

The human and commercial benefits of getting this right are BIG

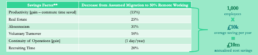

Banking and insurance have amongst the highest remote working potential of any sector, with around three-quarters of time spent on activities that can be conducted remotely, without the loss of productivity*

Indicate scale benefits of transitioning to 50% remote working are £10M annual savings per 1,000 employees

There are important human capital and reputational /social responsibility benefits to derive from improved employee experience and accelerated reduction in the organisation’s carbon footprint***

* Source McKinsey / What’s Next for Remote Working

** Source Global Workplace Analytics, Amazon, SHRM, Deloitte – average annual savings include the cost of office rent, electricity, water, insurance supplies. Savings based on full-time employees with compatible jobs telecommuting 20 hrs/wk. Assumes 2,000 hour work year and £70/hr labour rate

*** Source Carbon Trust / Homeworking

So… the questions we think you need to be able to answer are…

Strategy

Does your FoW vision and ambition reach far enough?

Is your FoW strategy holistic and clear on what benefits the new ways of working should deliver, in terms of

- human capital

- culture change

- productivity

- operational efficiency

- customer experience

- cost optimisation

- carbon reduction

How robust is the supporting business case and rationale?

Change Design

Do change designs have the necessary sensitivity and granularity at policy, process, controls and performance management levels? Do they have

- defined rules and variability on when in-person presence is required by specific roles, activity mixes and situations

- mitigations of risk of accentuating inequalities and creating new psychological or emotional stresses amongst employees

Test – Learn – Optimise

What will it take to pilot, refine and embed the transition effort successfully and at pace?

Enablement

What needs to be achieved to ensure the organisation and people are ready to adopt the new ways of working?

Have you identified/selected the optimal system, technology and data solutions to enable the hybrid working model?

Benefit Capture

To what degree can you be confident you have the right implementation plans, measures and capabilities to realise the target model and benefits?

We would welcome a discussion to understand where you are in moving from visioning to delivering FoW and which questions matter most to you, and to explore where Curzon’s capabilities may be relevant to your needs