Re-assessing cost after COVID-19

The global COVID-19 pandemic has provoked the need for businesses to re-assess their footprint and cost base across the supply chain. John Mason, Manufacturing & Engineering Services Partner at Curzon Consulting, considers the case for structural change.

Re-assessing cost after COVID-19

The COVID-19 crisis has altered the landscape for many. Some have already acted to reduce staff numbers and consolidate operations as an initial response to falling revenues. Structural change and a lower cost base may be required to adapt for the longer term driven by:

- Altered demand volumes, market location and mix of products and services as markets and the customer base evolves

- New regimes to protect health and wellbeing that change how people can work

- The increasing de-globalisation trend, prompting a re-think on the resilience of supply chains and moves to localise

The scenarios and options for each business will be different and the ‘best fit’ answer will not necessarily be obvious.

Considering the case for structural change

Supply-side capacity

- What capacity is needed now and for the medium term? Can excess capacity be re-purposed to meet expected new demand or is consolidation possible?

- Restructuring the footprint is an opportunity to deliver a step change in the cost base and renewed focal points for future investments

Network view

- How fit for purpose are existing facilities now? Can a more cost-effective and resilient model be found by looking at the network as a whole?

- Potential changes to both demand and supply-side environments will impact the economics of the current model and an holistic view is needed

Supply chain

- Will customers demand more localised sourcing to reduce interruption risk in their business-critical supply chains? Is a pre-emptive move to adapt the footprint more attractive than a reactive one?

- Sourcing and certifying new suppliers may be a critical dependency for re-locating production. It is also an opportunity to re-think make-buy strategies, secure new capabilities, strengthen key supplier relationships and unlock cost savings

Overhead right size

- What opportunities from changed working practices should now be evolved to deliver a lower overhead cost model?

- Remote working, greater comfort with and reliance on technology, and demonstrated operation with reduced indirect staffing levels creates new baselines for the operating model

Digital evolution

- What opportunities are created through a reshaping of the footprint to accelerate adoption of digital technologies?

- Relocation of capabilities to be better aligned with future demand will require assessment of products, processes, assets, resources and technology infrastructure. Introduction of technology to deliver cost and service advantage may be achieved in a more concentrated way, more quickly and with greater impact as part of a footprint reshape than through retrofit in a sub-optimal model

Affordability

- How will transition be funded and what prioritisation is required? A balanced-risk business case and plan are needed

- Parallel effort to drive out non-value-add activity, reduce working capital and target efficiencies in the current model will create additional headroom to manoeuvre

Having dealt with the immediate threat from COVID-19, executives, stakeholders and shareholders are now turning their attention to what comes next.

Businesses that are proactively considering the options now will be better placed to make the right moves to sustain and grow.

How we can help

We have broad experience of working with industrial clients to deliver higher levels of profitability and resilience by optimising the cost base, with managed risk and without compromising business value-add service delivery.

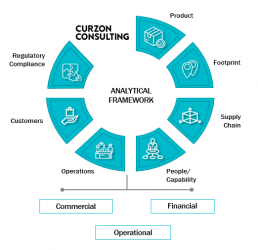

Our bespoke Assessment Model is a tried and tested approach balancing commercial, financial and operational considerations. We can rapidly examine the possibilities, frame the options and quantify the associated benefits and risks to underpin confident decision-making.

We bring a business-led focus, an insight-driven approach and a pragmatic attitude to help our clients make informed decisions. And where needed we assist in delivering the business case.

Contact us to explore how to deliver a more resilient and cost optimised business in a post-COVID environment.

Want to find out how our Industry & Energy Services consulting team can help?

Infrastructure after Covid-19 – when the mould is broken where do you want to be?

Competition or collaboration? Navigating change in infrastructure after Covid-19

The Covid-19 pandemic has brought about rapid unprecedented change. Companies have responded to imposed restrictions, people have adapted to new ways of working, and the impact on the economy, employment and productivity has been immense.

Businesses face an ever-shifting timescale for recovery but uncertainty on how they need to adapt in the short, medium and longer term.

A commitment to investment in infrastructure

With uncertainty over the shape of economic recovery, the UK government is under increasing pressure to provide answers. The current political agenda is balancing the risk of further outbreaks against the need to kick-start the economy and get people back to work. Infrastructure is a key part of this recovery plan.

As such, we are seeing a range of statements, commitments and emerging policies that::

- Commit to accelerated investment in infrastructure

- Criticise past failings in the delivery of major programmes which have taken too long and cost too much

- Question how other countries can do it so much better than us

- Recognise that we have developed a huge burden of bureaucratic processes

- Challenge the slow adoption of new technologies and innovation

- Reinforce previous goals on climate change and the environment

What does this mean for core infrastructure and regulated industries?

The services and facilities provided by infrastructure and regulated industries are essential to the future growth of the economy. The challenge is how to fairly manage the cost of recovery, which will ultimately be passed onto the consumer. This creates further pressure on the whole system including clients and service providers. Some key questions and considerations include:

For Clients (or sponsors)

- With greater pressure on household budgets, customer expectations on service and value will increase

- Customers will be less tolerant of failure and companies will be under greater scrutiny

- Social and environmental conscience is increasing

- As a result of COVID-19 there will be sustained change in the way people work. But is the full impact fully understood?

- Clients or sponsors will be under increased pressure from the regulators to deliver more for less

- Continuing to stretch existing resources and deliver incremental change will not be enough

- Companies will be driven to develop different and more efficient operating models

For Service Providers

- No longer contractors or consultants but “Service Providers”

- Has traditional contracting had its day and does it really deliver what clients and customers are ultimately looking for?

- Service Providers will be under the greatest pressure to address the higher-level challenges through creating new ways of working or new service offerings

- “Necessity is the mother of invention” – the time of greatest need will drive the greatest change and the more agile companies will be those that win

- Traditional contracts delivered in a traditional way will become an increasing “race to the bottom” based on price with associated increase in failure

Innovation and technology inevitably has a major part to play in addressing the above.

What part should Innovation and Technology play?

Regulated industries are notoriously slow adopters. If this is to change, it is essential to understand the reasons why and break these paradigms.

- Risk of failure is too high either in terms of impact on customers or regulatory action

- Procurement processes are cumbersome and often preclude SMEs/Start-ups

- In reality, Intellectual Property has a very short shelf-life, products are quickly copied

- There is more to be gained from running faster and letting others follow compared to standing still and protecting what you have got

With many organisations facing the same challenges, is there something to be learned from collaboration?

Competition or Collaboration?

Regulation has often been based on the premise of driving or simulating competition. So, what delivers the greatest benefit – organisations collaborating or competing? Many “alliance” delivery models are based on the benefits of collaboration which raises a number of questions:

- Regulated utilities by their nature are often monopolies so why isn’t there far greater collaboration and sharing of ideas?

- Technology/Innovation start-ups often have to prove their concepts several times over to separate clients passing through individual tortuous procurement routes. As a result many collapse before they start. As a wider industry why do separate companies re-invent the same wheel

- Contractors/Service Providers provide similar services to different clients and sectors in the same geographic area. Is there more to be gained from a common approach across sectors?

- If the same Service Provider is providing a service across multiple clients and sectors who is the regulator actually regulating – the Client or The Service Provider?

- If the end service across sectors is a similar service why should there be different regulatory models and different regulatory measures or even different regulators?

Acceleration, adaption and adoption

The COVID-19 pandemic has had an undeniable impact on organisations. Businesses have been forced to adopt a more radical and agile approach in how they adapt to change.

This unprecedented challenge has also created opportunities. Many businesses have failed but some have flourished. In the main, these organisations have embraced a culture of learning from others. They have collaborated and openly shared resources. They have undertaken the accelerated development of complex solutions and executed them with simplicity.

Going forward, significant commitments have been made, expectations are high and pressure on delivery will increase. The challenges will necessitate change and those that move fastest stand to gain the most.

The authors

Get in touch

We help infrastructure organisations to meet challenging targets through strategy, operating model design and transformation.

Contact us to discuss how we can help your organisation.

Want to find out more or meet one of our Infrastructure team? Contact us by email, phone or our web form.

Digital productivity management in infrastructure

The full package: digitising productivity management in infrastructure delivery

Infrastructure owners and construction companies are selecting or developing, and then seeking accelerated implementation and scaling of, their preferred digital productivity management tool(s).

In consideration of the current economic climate, the critical role that Infrastructure investment is set to play in boosting growth has been amplified.

In light of these two factors, it does not feel as though there could be a better time to suggest that if we are going to do the whole ‘digital productivity thing’ in infrastructure and construction… we should do it properly. So, what does ‘doing it properly’ mean? It means that it is time to assess the full spectrum of construction-site productivity management capability areas that can be enhanced through the new or improved application of digital tools. We need the full package.

Unlocking greater efficiencies through digital

Digital enablement has revolutionised productivity and the definition of efficiency norms in other industries. Most notably in Manufacturing industries such as Fast-moving consumer goods (FMCG) where market leaders such as Unilever have reduced material factory waste by more than 40% by digitally enabling end-to-end quality management. (Source: World Economic Forum, How manufacturing can thrive in a digital world and lead a sustainable revolution, January 2020)

Similarly, by 2025 the digital enablement of Logistics has the potential to reduce global carbon emissions by 11%. (Source: World Economic Forum, Digital Transformation of Industries Demystifying Digital and Securing $100 Trillion for Society and Industry by 2025, January 2016) A powerful endorsement of advanced productivity management tools.

The Agriculture industry presents further evidence. Here, as an example, data gathering and historical analysis data-driven decision-making tools are having a transformative impact on crop productivity.

Productivity management in infrastructure however is often driven by manual cost and performance benchmarking processes. Some efficiency gains have been achieved through the successful adoption of Lean methodologies. But the meaningful use of digital tools that enable higher productivity rates will be key to unlocking much greater efficiencies in the construction phases of infrastructure programmes.

There is an entire spectrum of construction site productivity management capability areas that can be enhanced through the application of digital tools. These can be broadly placed into three categories:

- Planning and Collaboration: Ensuring the feasibility of planned activities and improving communications between the site and site-office

- Data gathering: Gathering data on the work accomplished on-site to feed performance/progress metrics

- Data-driven analytics: Collecting historical productivity data on-site to feed data-driven decision making

In pursuit of significant improvement

Organisations tend to focus on the independent application of a discrete digital tool to enable productivity. Most often this means dedicating themselves to a data gathering tool for the purpose of productivity tracking. However, in the pursuit of significant efficiencies it is not sufficient to introduce digitally enabled capability to just one area of the productivity management spectrum. For infrastructure delivery, at the construction site level, a suite of digital tools covering the full range of capabilities (outlined at a high level by the three categories above) is required. Many of the more recently developed tools incorporate data as a service (DaaS) offerings but there is the opportunity to go further. Attributes for productivity information gathered, processed and analysed should adhere to the standards set by data and information frameworks being built by infrastructure owners.

For data generated by any suite of tools, there is the opportunity to actively inform cost and performance benchmarks and subsequently productivity norms for the delivery of work. This applies within the integrated environment for information that programmes, alliances or organisation level data frameworks house.

So how to decide on which digital productivity management tools to work with?

Whether through in-house development or accessing solutions already in play, several factors should be considered, including but certainly not limited to:

- Ease of implementation

- Supply chain buy-in

- Scalability across multiple construction disciplines

Prioritisation frameworks can be designed and applied to rapidly assess an entire landscape of digital productivity management solutions, thoroughly reviewing each through the lenses of standard attributes.

Digital productivity done properly

Individual tools applied in isolation in areas such as productivity tracking can offer benefits. But there is an entire spectrum of on-site productivity management capability that can be enhanced through the application of digital tools. These benefits can be amplified through alignment with the principles for data defined by information frameworks being developed by infrastructure owners. Other industries are demonstrating the scale of productivity benefits available through digital enablement. These are most notable where a complete end-to-end process approach is adopted.

So, if we are going to do the whole ‘digital productivity thing’ in infrastructure and construction… we should do it properly.

The authors

How we can help: Rapid Digital Portfolio Prioritisation

Siloed innovation, functional misalignment and data ‘doing its own thing’ are just a few challenging features of the current congested-frontier of digital transformation.

Applying our bespoke prioritisation framework(s), Curzon Consulting takes 4-6 weeks to rapidly assess an organisation’s entire landscape of digital solutions and initiatives. We thoroughly review each through the lenses of attributes that are orientated around features such as financial benefit, scalability and interoperability.

Get in touch to find out how we can help or arrange a free virtual meeting with award-winning Principal consultant, Edem Eno-Amooquaye.

Want to find out more or meet one of our Infrastructure team? Contact us by email, phone or our web form.

Global consulting network Nextcontinent renews governance

‘Glocal’ consulting network for the future

Curzon Consulting is a citizen of international consulting network Nextcontinent. The network has 7,600 professionals, generates US $1 billion and is present in 40 countries. Created less than 10 years ago, Nextcontinent is already ranked among the top 15 consulting networks in the world.

Its 17 citizens – independent consulting firms – have just reelected Francis Rousseau, Chairman and founder, and François Pouzeratte, General Manager – to head this “consulting network for the future”.

The mission of this multi-local and multi-skills player is to help major international clients on a global scale.

Nextcontinent governance until 2023

Francis Rousseau, Chairman and founder of Nextcontinent, and François Pouzeratte, General Manager, have been elected for a new three-year mandate (2020-2023).

Thanks to the strong commitment of the team and the successful expansion and development of the network, the 17 citizens have unanimously voted in favor of the renewal of this Governance, which will be reinforced by the creation of a new Business Community Leader Committee.

New Nextcontinent member firms

Over the last 12 months, 5 new citizens joined the network:

- Matrix Consulting, HQ in Chile, strategy consulting company, 100 employees

- Paradigma, HQ in Argentina, management consulting company, 250 employees

- DMW, HQ in the UK, IT strategy consulting company, 140 employees

- Prospectus, HQ in Ireland, management consulting company, 7 employees

- Point B, HQ in the US, management consulting company, 1,000 employees

- Visagio, HQ in Brazil and Australia, management consulting company, 500 employees

About Nextcontinent

After seven years, Nextcontinent is a worldwide consulting network, with more than 7,600 professionals generating US $ 1 billion and present in 40 countries (Europe, Americas, Asia and Middle East). Nextcontinent, a multi-local player and multi-skills network (from consulting to engineering) is now ranked among the top 15 consulting networks in the world.17 independent consulting firms, each with a leading position in their respective countries, decided to join forces to create an ambitious international project aimed at helping major international clients on a global scale. Called a “consulting network for the future,” Nextcontinent is a new type of organization.

The vision of Nextcontinent is to keep on growing to act among the major international consulting players. For that, the new three-year project aims at strengthening the cooperations and the value delivered by the professional teams locally and globally.

Nextcontinent offers a global perspective in all economic areas, with a large portfolio of expertise – Strategy & Management Consulting, Engineering, Digital & IT, Human Resources & Coaching – shared and developed in its Business Communities. The Business Communities are comprised of international teams of partners and managers that share a common goal: to satisfy clients globally and locally through their obsession with innovative products and high-quality results. Business communities are fully business-oriented and work on key business issues for the future. They publish international studies, position papers and value new ideas. They are also the place for knowledge sharing and developing new methodologies and innovative techniques.

François Pouzeratte said:

Nextcontinent is a world-wide consulting network, based on the mutual desire to work together, or affectio societatis, trust and open mindedness rather than capital gain or other transactional or financial approaches. The 7,600 professionals from our 17 citizens work together on what is useful for society today and what will be meaningful in tomorrow’s world. Companies will have to adapt their strategies to people and not the other way around. The bottom-up will replace the top-down. The post-Covid economic crisis, which promises to be severe and lasting, should further enhance the uniqueness of Nextcontinent. Our network is a human network, with Citizens who place people at the heart of organizations. It is this DNA that our customers – including major global companies – appreciate”

The next Partners Meeting, with more than 100 partners, will focus on the future of work, linked to the future of mobility.

Communication contact

(Paris, France): Cécile de Visme